It may appear to be confusing to discover that your automobile has been considered “a total loss” by your insurance carrier, and you are able to drive it around with no problems. You may question how a car that operates flawlessly can be regarded as a complete loss. The truth is that “total loss” is merely an insurance phrase based on the price of repairing your car versus its true cash value.

The time has come for you to make a very essential determination concerning your automobile that will have a considerable effect on both your economic situation and your mode of transportation. In order to make the best possible decision in accordance with your circumstances, it is crucial to comprehend the meaning of “total loss,” understand your choices, and learn how to successfully navigate the claims procedure of your insurance provider.

Let's Go Beyond, to Bring You Back

Let's get you the compensation you're entitled to. Get a FREE Consultation today.

Let's Go Beyond, to Bring You Back

You deserve the compensation you’re entitled to, call for your FREE Case Review today.

Understanding Exactly What “Total Loss” Really Signifies

When the expense to fix your car surpasses a predetermined percent of its Actual Cash Value (ACV), the car is regarded as being a “total loss.” Most insurance providers employ a range of 70% to 80%, although this figure may differ according to the jurisdiction where you reside and the insurance provider that you utilize. For instance, let’s say that your automobile is valued at $10,000 and repairs will cost $7,500; your insurance provider will probably consider it a total loss since it does not seem financially viable to them to repair it.

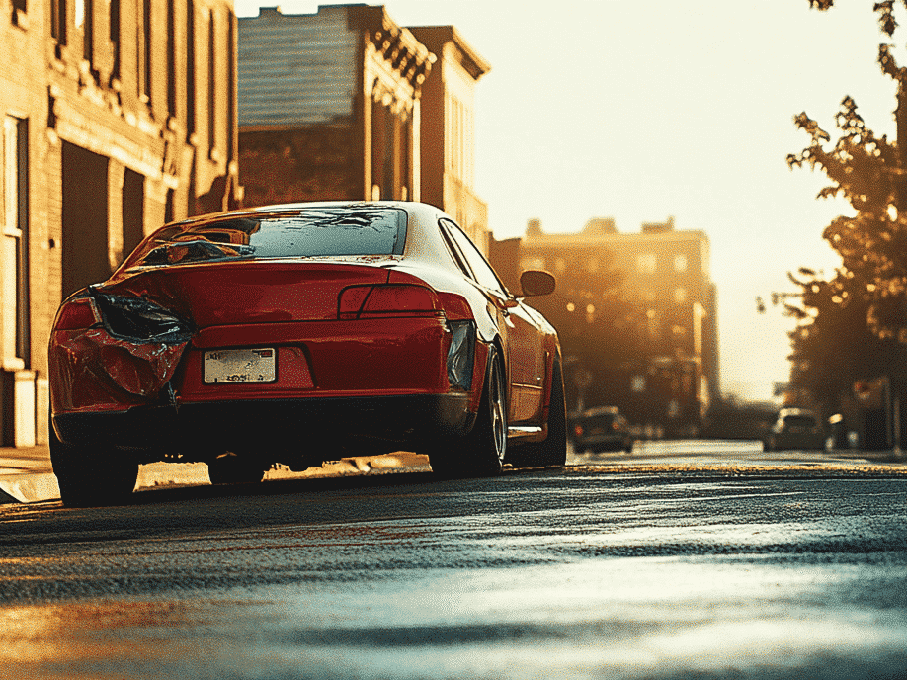

This analysis has absolutely nothing to do with whether your automobile works. Your automobile could have sustained significant body damage due to a crash, flooding damage that may affect its dependability in the future, or frame damage that is expensive to fix, yet your car may begin and operate normally. As a result of this, many individuals find themselves in the above-mentioned apparently contradictory circumstance.

Alternatives When Your Automobile Has Been Declared a Total Loss

You have two primary courses of action once your insurance carrier declares your automobile a total loss. The first course of action is to accept the payment made by your insurance company for the total loss of your automobile and give the vehicle back to your insurance company. Your insurance provider will pay you the actual cash value of your automobile (less your deductible), acquire ownership of the vehicle, and sell it for salvage. This is the easiest method to go and will allow you to purchase a brand-new vehicle.

The other course of action is to retain your automobile. If you decide to retain your automobile, your insurance company will provide you with a payment for the total loss of your automobile; however, the insurance company will deduct the salvage value of your automobile from the payment (the sum of money that the insurance company could have received from selling your automobile for salvage). Additionally, your automobile will be assigned a salvage title, which may create additional difficulties in the future. Although retaining your automobile may appear illogical since it has been declared a total loss, retaining your automobile may be a logical decision to retain the use of your automobile if you possess your automobile free and clear and are searching for a cheap alternative to purchase a vehicle.

Are You Able to Continue to Operate a Vehicle That Has Been Declared a Total Loss?

You can continue to operate a vehicle that has been declared a total loss, but there are various factors you should take into consideration. When you sustain an automobile accident, and the vehicle is still operable prior to processing your claim through your insurance carrier, you are usually permitted to continue operating the vehicle. However, when your vehicle is assigned a salvage title (as is the case if you elect to retain your vehicle), the laws regarding the operation of your vehicle become far more complex.

In the majority of jurisdictions, you will be unable to lawfully operate a vehicle that has been assigned a salvage title unless you have your vehicle inspected and obtain a rebuilt title. This process includes obtaining the necessary repairs, submitting the vehicle to a DMV or an authorized inspection station for an inspection, and requesting a rebuilt title.

The procedures for acquiring a rebuilt title will vary depending upon the jurisdiction in which you reside. You will need to determine the regulations that govern your location.

Further, purchasing an insurance policy for a vehicle with a salvage or rebuilt title may be difficult. Many insurance carriers do not offer full insurance coverage for vehicles that have a salvage or rebuilt title. Consequently, if you are involved in another automobile accident, you will not be eligible for reimbursement for damages to your vehicle.

Texas Car Accident Lawyer

Get Compensated For Your Injuries & Damages! Call Us For A FREE Case Review And Know What Your Case Is Worth.

What Happens If Your Car Has Been Declared a Total Loss and You Decide to Retain It?

If you decide to retain your automobile when it has been declared a total loss, you will be required to address a variety of important matters, and you will need to be aware of the long-term effects of retaining a vehicle that has been declared a total loss. First, you will need to notify your insurance carrier that you wish to retain your automobile. Your insurance carrier will then adjust the amount of money paid to you for the total loss of your automobile by reducing the amount of money paid to you by the amount of money that represents the salvage value of your automobile, typically 20-40% of the ACV of your automobile, though this is dependent upon the insurance carrier.

Secondly, your automobile will be issued a salvage title, and this designation will remain as a permanent record of the history of your automobile. In order to lawfully operate your automobile, you will be required to have it repaired (if necessary), undergo a state inspection, and request a rebuilt title. This process will necessitate documentation, the submission of fees for inspections, and possibly photographs documenting the completion of the repairs in compliance with all applicable standards.

There are a number of negative consequences associated with retaining a vehicle that has been declared a total loss, including the fact that the resale value of your vehicle will likely be substantially decreased (usually 20-40% less than a similar vehicle with a clean title), you will experience difficulty in finding an insurance carrier that offers comprehensive insurance coverage, and there may be reliability concerns regarding your vehicle if the damage was extensive. Nevertheless, if you are handy with repairs, the vehicle has sentimental value, or you require affordable transportation, and your vehicle is in good working condition, retaining your automobile may represent a practical solution.

Ways to Maximize the Amount of Money Received from Insurance for a Vehicle Declared a Total Loss

To achieve the greatest possible amount of money from your insurance carrier for a vehicle that has been declared a total loss, you will need to prepare and engage in negotiation. Begin by researching the actual cash value of your vehicle before the accident by using sources such as Kelley Blue Book, NADA Guides, and Edmunds. Review examples of vehicles that are comparable to yours, with the same mileage, in similar condition, and with similar features. By doing so, you will be able to develop a solid basis of evidence to support your case.

Gather all relevant information related to the condition of your vehicle prior to the accident. Collect all maintenance records indicating routine maintenance, receipts for previous repairs or improvements, and photographs illustrating the pristine condition of your vehicle. If you have installed features such as a high-end sound system, new tires, or improved wheels, be certain to incorporate those into the valuation of your vehicle.

Review the initial offer provided by your insurance carrier and examine the valuation report provided. Verify whether the description of your vehicle in the report contains errors, whether any features have been omitted, or whether the comparable vehicles listed do not actually resemble your vehicle. Do not be reluctant to contest their valuation with your own research. Insurance adjusters anticipate that there will be some level of negotiation, and many initial offers contain a degree of latitude for adjustment.

Consider employing an independent appraiser if the difference between the offer made by your insurance carrier and your research is substantial. Although you will incur a fee for the services of an independent appraiser (generally $200-$500), it may be worthwhile if it leads to a greater payment. An independent appraisal will generate a professional document that will have a positive influence during the negotiation process.

Should I Accept the Initial Payment Made by My Insurance Carrier for a Vehicle Declared a Total Loss?

Most professionals advise against accepting the first offer made by your insurance carrier without conducting preliminary research. Insurance companies generally submit the initial offers at the lower end of the reasonable valuation range, anticipating some level of negotiation. This does not indicate that they are attempting to deceive you — it is simply customary practice in the insurance industry.

Examine the offer made by your insurance carrier thoroughly and evaluate it relative to your research. If the offer appears to be fair and consistent with the market data and accurately represents the pre-accident condition of your vehicle, accepting it may be a wise decision, particularly if you are under pressure to proceed quickly. If you identify disparities or believe the offer is too low, you have the authority to negotiate.

The critical factor is to enter into negotiations in a professional manner and with documentation. Provide specific comparative vehicles, maintenance records, and a detailed explanation for why you believe a higher valuation is warranted. Most insurance companies will negotiate with you if your counteroffer is reasonable and supported by documentation.

You should realize that you can also negotiate the salvage value if you are going to retain the vehicle. If the insurance company’s salvage value estimate appears too high, show them the sale prices of similar salvage vehicles. The lower you can get the salvage value, the larger your settlement will be when you retain your vehicle.

Do I Keep My Car? Do I Give It Up?

Whether you should keep your totaled but still running vehicle is dependent on your personal situation. You should consider your financial status, your need for transportation, your ability to work on your own vehicles, and your long-term goals. If you owe money on your vehicle, check with your lender – they may require you to give up the vehicle because they have a claim to it.

If you own your vehicle free and clear, it is mechanically good, but cosmetically damaged, and you feel comfortable driving a vehicle with a salvage title, retaining your vehicle may be the most fiscally responsible thing to do. On the other hand, if you require full coverage from your insurance company, plan to sell or trade your vehicle quickly, or are concerned about undiagnosed problems with your vehicle, taking the insurance company’s offer and moving on would be the better option.

Regardless of which option you choose, make sure you know all the ramifications of your choices and the requirements of your state. Your insurance agent and your state’s Department of Motor Vehicles (DMV) can help guide you through the process and provide insight into the challenges that lie ahead. When you have the proper information, you can transform a difficult situation into one that meets your needs and fits within your budget.

Let's Go Beyond, to Bring You Back

Let's get you the compensation you're entitled to. Get a FREE Consultation today.

Let's Go Beyond, to Bring You Back

You deserve the compensation you’re entitled to, call for your FREE Case Review today.

Commonly Asked Questions

What does it mean when your vehicle is declared totaled but still runs?

When your vehicle is declared totaled but still runs, it means the cost to fix your vehicle is greater than its fair market value; thus, the insurance company has declared it a total loss even though your vehicle runs and drives. Even though you may still want to continue to run your vehicle, it may be wise to investigate other alternatives.

What are some immediate actions I should take if my vehicle is totaled but still runs?

First, call your insurance provider to let them know about the accident and to see if you have any options available under your policy. Next, obtain repair quotes to determine your costs, and then decide what to do next.

How do I decide whether to keep or sell my vehicle after it has been totaled?

To decide whether to keep or sell your vehicle after it has been totaled, calculate your repair costs versus your vehicle’s market value, and consider any emotional attachment you have to your vehicle versus any practical advantages you receive by retaining your vehicle. Also, think about how your decision may impact your future insurance coverage.

How does having a vehicle that has been declared totaled affect my future insurance coverage?

Having a vehicle that has been declared totaled may increase your insurance rates and limit your coverage options because insurance companies often view these vehicles as being at a higher risk. You should talk to your insurance provider to determine your options for the future.