Key Takeaways

- Understanding reasons for insufficient insurance payouts, such as lowball estimates, policy exclusions, and depreciation, is crucial for negotiating effectively.

- Thoroughly reviewing your insurance policy and documenting all damage can strengthen your case when seeking a reassessment or disputing a claim.

- Exploring options like independent appraisals, mediation services, and legal representation may be necessary if informal negotiations with insurance companies fail.

Let's Go Beyond, to Bring You Back

Let's get you the compensation you're entitled to. Get a FREE Consultation today.

Let's Go Beyond, to Bring You Back

You deserve the compensation you’re entitled to, call for your FREE Case Review today.

Understand the Reasons for Insufficient Payouts

Addressing an insufficient insurance payout begins with understanding why it might be insufficient. Several factors can contribute to a lower-than-expected settlement, and knowing these can help you prepare and respond effectively.

Insurance companies might offer lowball estimates, exclude certain damages based on policy terms, or reduce payouts due to depreciation, all of which can lead to potential costs that significantly impact the amount you receive.

Lowball Estimates

Lowball estimates from insurance adjusters are a common reason for insufficient payouts. These professionals may undervalue the damage due to oversight or to save money for the company, resulting in an initial offer that is significantly lower than the actual repair costs.

In such cases, negotiation is key. Contest the initial offer by providing specific details and evidence of the full cost of repairs or replacements. An independent appraisal can support your case and help secure a fair settlement.

Policy Exclusions

Another factor that can affect your insurance payout is policy exclusions. Insurance companies often have specific exclusions written into their policies that outline what is and isn’t covered. For instance, certain types of water damage or mold may not be covered by your insurance policy.

Reading your policy carefully and understanding these exclusions can help set realistic expectations and avoid surprises when filing a claim.

Depreciation and Actual Cash Value

Depreciation can have a significant impact on the value of your insurance payout, especially if your policy is based on Actual Cash Value (ACV). ACV policies deduct depreciation from the payout, which can result in a much lower amount than the replacement cost.

Knowing the difference between ACV and replacement cost policies is important. While ACV accounts for depreciation, replacement cost policies cover the full cost of replacing damaged property without deducting for depreciation.

Review Your Insurance Policy Thoroughly

Reviewing your insurance policy thoroughly can help avoid surprises. Understanding your coverage limits, exclusions, and conditions ensures the payout aligns with your needs.

Check your policy to understand its terms, including the appraisal clause, which permits hiring independent appraisers to evaluate damage. Knowing your policy thoroughly empowers you to advocate effectively for yourself.

Document All Damage and Costs

Thorough documentation is key to dealing with insurance claims. Keeping a detailed record of all damage and associated costs that have been filed can strengthen your case.

To enhance your chances of getting a reassessment and fair settlement:

- Take photos and videos of the damage.

- Write detailed incident accounts.

- Keep records of all communications with your insurance company.

- Gather repair receipts.

- Document any preventative measures taken.

This thorough documentation can significantly enhance your chances of getting a significant portion reassessment and fair settlement.

Request a Reassessment

If the initial assessment by the insurance adjuster seems incorrect, consider the following steps:

- Request a reassessment, as many insurance companies allow for a second opinion or re-evaluation of claims.

- Build your case with thorough documentation and evidence to strengthen your position when negotiating.

- If verbal negotiations don’t work, submit a written dispute to show seriousness and create a paper trail.

Two effective approaches are independent appraisal and mediation services.

Independent Appraisal

Hiring an independent appraiser to assess the damage can provide an unbiased estimate. This neutral third party offers a perspective on the actual cost of damages that may differ from the insurer’s estimate.

The appraisal process involves both parties agreeing on an appraiser and possibly an umpire to resolve disputes, leading to a fairer assessment and potentially a better settlement.

Mediation Services

Mediation services streamline communication and facilitate a more amicable negotiation process. A mediator ensures both sides understand each other’s positions and work towards a common resolution.

Mediation can lead to more efficient resolutions and potentially better outcomes for both the policyholder and the insurance company, saving time and reducing the stress of disputes.

Let's get you the compensation you're entitled to. Get a FREE Consultation today. You deserve the compensation you’re entitled to, call for your FREE Case Review today.

Let's Go Beyond, to Bring You Back

Let's Go Beyond, to Bring You Back

Dispute the Claim

When informal negotiations fail, formally disputing the claim is the next step, requesting that discrepancies in policy interpretation be addressed. Discrepancies in policy interpretation can lead to disputes, as insurers may favor interpretations that limit their liability, determining the outcome of the claim.

To dispute a claim you believe was undervalued, follow these steps:

- Submit a written dispute letter clearly stating your reasons for believing the claim was undervalued.

- Provide documentation to support your dispute, such as repair estimates and photos.

- This process creates a record of your efforts to resolve the issue.

File a Complaint with State Insurance Departments

If you disagree with the insurance company’s assessment, file a formal complaint with your state insurance department. Common reasons for filing complaints include delays, denials, and unsatisfactory claim settlements.

Visit your state’s Department of Insurance website and fill out the required form, including personal details and supporting documents. State insurance departments and insurance commissioners in many states take consumer complaints seriously and can assist in resolving disputes. If you need assistance, you can also contact them directly.

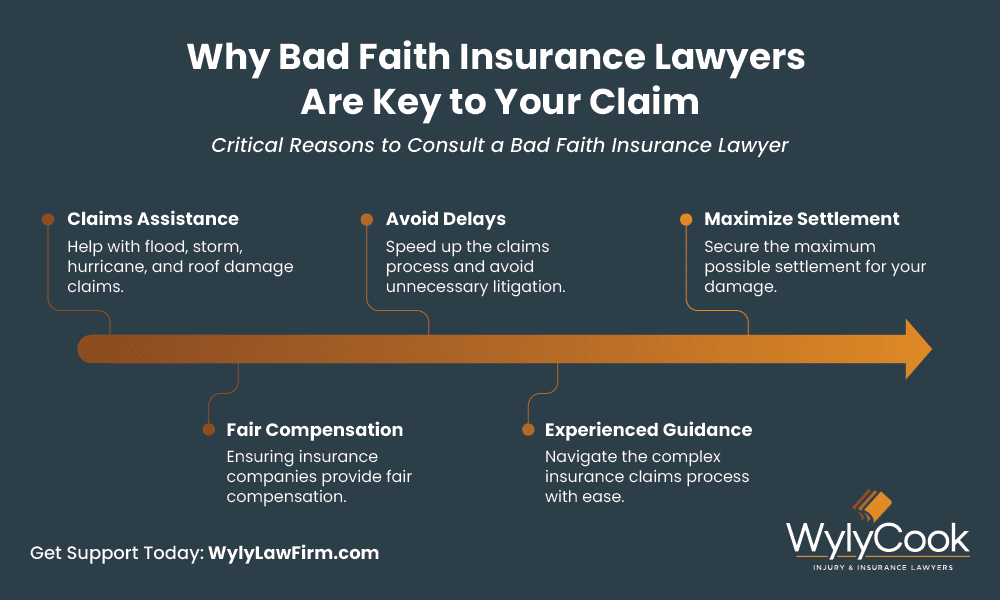

Explore Legal Options

If all else fails, exploring legal options might be necessary. A qualified attorney can review your case, assess the evidence, and determine if your insurer acted in bad faith. Filing a lawsuit can be an option if your insurance company does not provide a fair settlement.

Two specific legal options are bad faith practices and contingency-based representation.

Bad Faith Practices

Insurance companies may exhibit bad faith by denying valid claims without justification. If an insurer acts in bad faith, it may be liable for damages beyond the original claim amount. Proving bad faith practices can lead to additional compensation for emotional distress or punitive damages, incentivizing insurers to act in good faith.

Contingency-Based Representation

Contingency representation means attorneys are paid only if you win the case, making legal help accessible. This is a good option if you’re worried about paying upfront legal fees.

This approach allows you to pursue your claim on behalf of your interests without financial risk, ensuring you have professional lawyer representation to navigate law complexities and seek to advocate for your rights in court.

Consider Additional Coverage Options

Additional car insurance coverage can help avoid financial shortfalls after an accident. Options like gap insurance and UM/UIM coverage provide extra protection.

These coverages ensure you’re not left with significant out-of-pocket expenses and offer peace of mind knowing you’re fully covered with full coverage and health insurance.

Gap Insurance

Gap insurance covers the difference between the insurance payout and your car’s loan balance after a total loss, preventing you from making payments on a car you can’t drive.

Those with long loan terms or low down payments should consider purchasing gap insurance to avoid financial hardship in case of a total loss.

UM/UIM Coverage

UM/UIM coverage is crucial when the responsible party lacks sufficient insurance for damages, protecting you from financial losses when the at-fault party’s insurance doesn’t fully cover medical bills and damages.

It becomes active when the other driver’s insurance reaches its maximum payout, allowing you to claim additional compensation and ensuring you’re not left out of pocket.

Let's Go Beyond, to Bring You Back

Let's get you the compensation you're entitled to. Get a FREE Consultation today.

Let's Go Beyond, to Bring You Back

You deserve the compensation you’re entitled to, call for your FREE Case Review today.

Frequently Asked Questions

What should I do if my insurance payout is lower than expected?

If your insurance payout is lower than expected, first review your policy and document all damages. Then, request a reassessment and, if needed, dispute the claim or consider legal options.

How can I avoid lowball estimates from insurance adjusters?

To avoid lowball estimates from insurance adjusters, present detailed evidence of repair costs and consider obtaining an independent appraisal. Being ready to negotiate can further strengthen your position.

What are policy exclusions, and why are they important?

Policy exclusions are specific damages or circumstances that your insurance policy does not cover, and they are crucial because they help you set realistic expectations and avoid unexpected denial of claims. Being aware of exclusions ensures you have a clearer understanding of your coverage.

What is the difference between Actual Cash Value and replacement cost policies?

The key difference is that Actual Cash Value (ACV) policies consider depreciation, leading to lower payouts, whereas replacement cost policies provide full coverage for replacing damaged property without deducting for depreciation.

When should I consider legal action against my insurance company?

You should consider legal action against your insurance company if your claim is denied without valid reasons or if they are acting in bad faith. Consulting an attorney can help you assess your situation effectively.